Like much of the world I tuned in last week to watch Tim Cook unveil the latest Apple products and services. Afterwards, I was curious to see the analysts and so called “tech experts” reactions on the announcement. Most were ho-hum “nothing new here”, and “it was what we expected,” the market response was similar, with the stock getting a small bounce then falling after the announcement.

Apple, better than anyone, gets the “use case” right for its technologies. And it is why I was surprised by the media and analysts reaction. Listening to the announcement and recap, most of the focus on Apple Pay was on Retail use. In the press release, Apple discusses the near field communication (NFC) technology, names its retail, credit card and bank partners. Pointing out that there are merchants ready to accept Apple Pay as a very secure payment method. But nothing that really got the media excited, go into any Starbucks on any day and you will see plenty of mobile transactions.

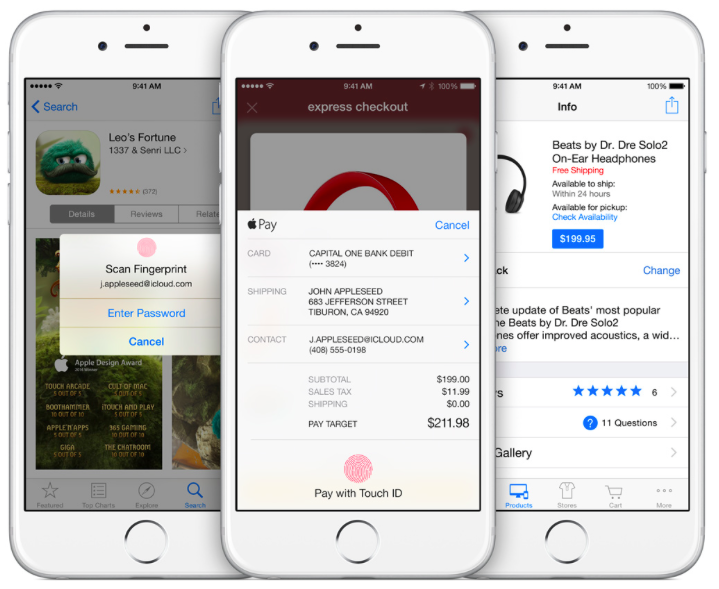

Digging a little deeper, buried at the bottom of the announcement is something more intriguing – “Touch ID” which enables “one touch checkout” for Online Shopping Apps. Say good-bye to the hassle of entering your credit card information on the small screen. See something you like, touch it, and it’s yours!

App developers have already started building Touch ID into retail apps. On the same day of Apple Live, Target announced that it has adopted the Like2Buy platform that which allow the chain’s Instagram followers to buy products featured in photos and Target is now integrating Touch ID into its mobile app. Touch ID for mobile apps is the big deal, but not for the reasons you might think.

Apple is a “big play” kind of an organization. A $349 watch, and people upgrading to an IPhone 6 isn’t going to move the needle for a $171 billion dollar company. Apple Pay helps but that’s a basis points play that gets split multiple ways between the service provider, credit card company, the bank, etc., and it will take years for it to be widely accepted. So where’s the “big play” with Apple Pay?

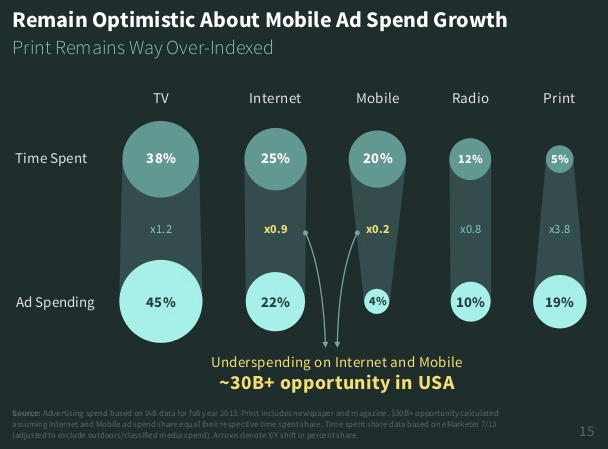

It’s mobile advertising. According to Mary Meeker in her 2014 Internet Trends report, mobile advertising represents a $30B opportunity in the US alone, based on time on device. Ad spend has lagged because of issues relating to tracking and measurability.

This is why Apple Touch ID is so important; it has the potential to improve tracking, measurability and ROI significantly. With TouchID the buyers never leaves the screen to transact. Attribution, tracking and conversion rates will improve, but the challenge remains — how do you get consumers to transact?

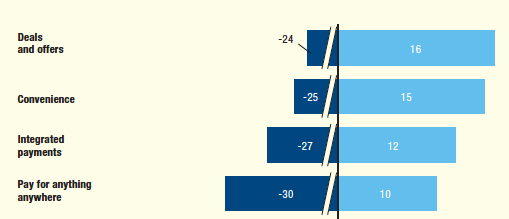

According to McKinsey’s From solutions to adoption: The next phase of consumer mobile payment, you give them a special deal or offer – an ad. There’s the closed loop.

Most important Drivers of Mobile Payments

Respondents ranking most important (light blue) and least Imports (dark blue)

Apple has had a long history of introducing products at the beginning of the “hockey stick”, usually relating to the consumer adoption curve of new technologies, this time the hockey stick is mobile advertising. The real payoff of Apple Pay for now, in my humble opinion, is not retail, it’s mobile and it is about buying on your phone versus paying with your phone.